food tax in massachusetts calculator

Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625. Massachusetts sales tax rates vary depending on which county and city youre in which can make finding the right sales tax.

Tax Calculator For Items Online 50 Off Www Ingeniovirtual Com

Companies or individuals who wish to make a qualifying.

. This income tax calculator can help estimate your average income tax rate and your salary after tax. This takes into account the rates on the state level county level city level and special level. The calculator on this page is provided through the.

DTA pays out the supplement on the second business day of each month often a. Exact tax amount may vary for different items. Food tax in massachusetts calculator Friday February 18 2022 Edit.

The statewide sales tax rate of 625 is among the 20 lowest in the country when including the local taxes collected in many other states. Massachusetts Income Tax Calculator 2021. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

The most significant taxes in Massachusetts are the sales and income taxes both of which consist of a flat rate paid by residents statewide. Overview of Massachusetts Taxes. Counties and cities are not allowed to collect local sales taxes.

Find your Massachusetts combined state and local tax rate. The most populous county in Massachusetts is Middlesex County. No Massachusetts cities charge their own local income tax.

Food clothing items under 175 admissions sales and most utilities and heating fuel are exempt from the Massachusetts sales tax. The average cumulative sales tax rate in the state of Massachusetts is 625. 2022 Massachusetts state sales tax.

The Massachusetts income tax rate is 500. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. To learn more see a full list of taxable and tax-exempt items in Massachusetts.

Important note on the salary paycheck calculator. The Massachusetts state sales tax rate is 625 and the average MA sales tax after local surtaxes is 625. The meals tax rate is 625.

For example while a ready-to-eat sandwich sold at a deli would be taxable. During the COVID-19 pandemic health emergency all households eligible for a SNAP benefit receive at least the maximum SNAP amount for their household size. 15-20 depending on the distance total price etc.

If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667. Massachusetts is a flat tax state that charges a tax rate of 500. To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

After a few seconds you will be provided with a full breakdown of the tax you are paying. How many income tax brackets are there in Massachusetts. This calculator does not include the supplement.

The state income tax system in Massachusetts only has a. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor If a liquor license holder operates a restaurant where meals are served.

Groceries and prescription drugs are exempt from the Massachusetts sales tax. The base state sales tax rate in Massachusetts is 625. This calculator is detailed and is designed for advocates or others familiar with Excel and the SNAP rules.

That goes for both earned income wages salary commissions and unearned income interest and dividends. This page describes the taxability of food and meals in Massachusetts including catering and grocery food. The state income tax rate in Massachusetts is 5 while federal income tax rates range from 10 to 37 depending on your income.

Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. These businesses include restaurants cafes food trucks or stands coffee shops etc.

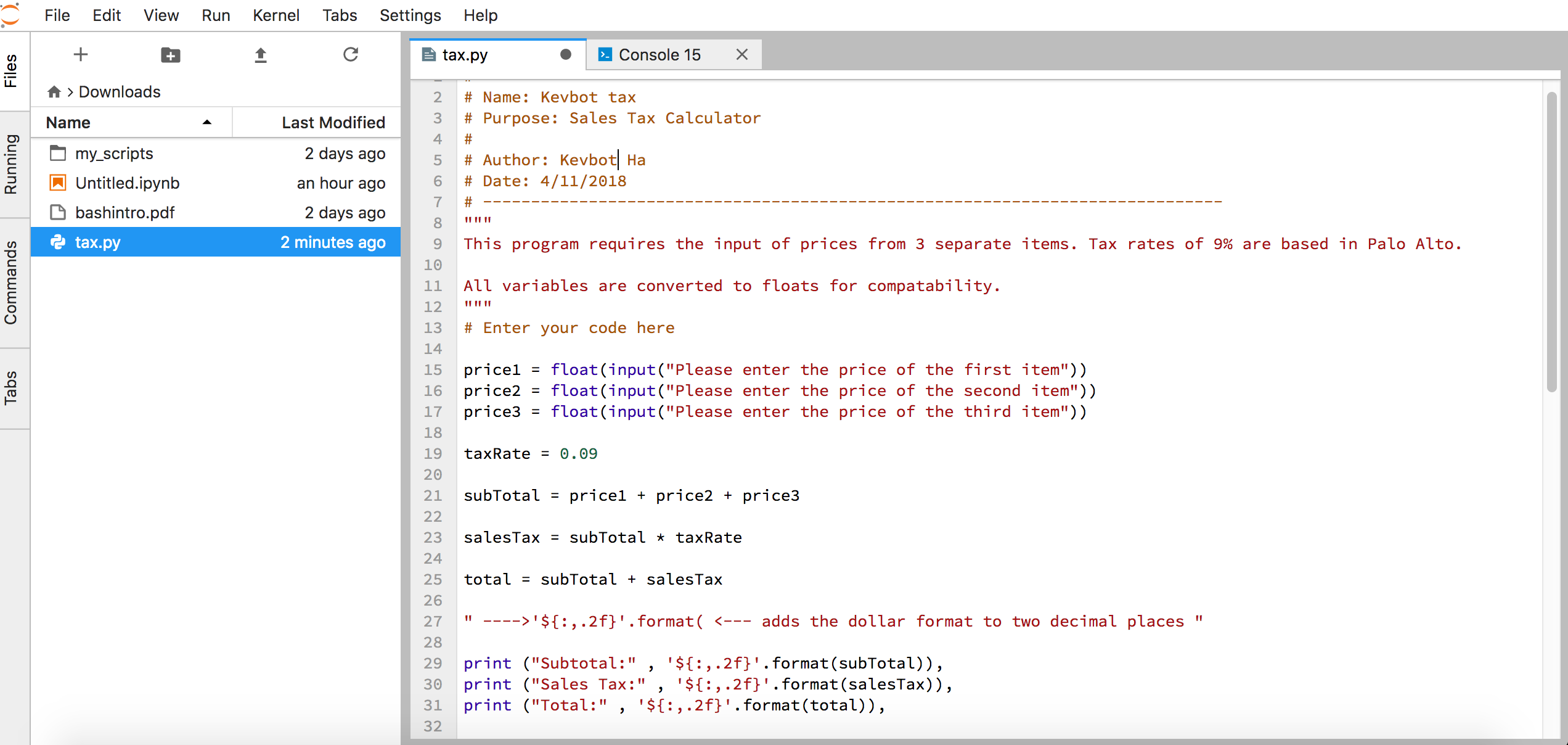

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Massachusetts local counties cities and special taxation districts. Food sold by a business that is primarily engaged in the business of selling meals is taxable at the Massachusetts meals tax rates. Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

You can use our Massachusetts Sales Tax Calculator to look up sales tax rates in Massachusetts by address zip code. In some states items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate. Massachusetts has a 625 statewide sales tax rate and does not allow local.

Massachusetts law makes a few exceptions here. Go to the Massachusetts Online SNAP Calculator.

Investing Rental Property Calculator Roi Mls Mortgage

Tax Calculator For Items Online 50 Off Www Ingeniovirtual Com

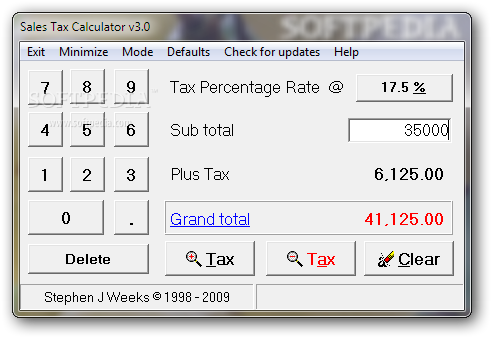

How To Calculate Sales Tax On Calculator Easy Way Youtube

Calculate The Sales Taxes In The Usa For 2022 Credit Finance

Tax Calculator For Items Online 50 Off Www Ingeniovirtual Com

Tax Calculator For Items Online 50 Off Www Ingeniovirtual Com

How To Calculate Sales Tax Math With Mr J Youtube

Income Tax Calculator 2021 2022 Estimate Return Refund

Massachusetts Sales Tax Calculator Reverse Sales Dremployee

Tax Calculator For Items Online 50 Off Www Ingeniovirtual Com

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Tax Calculator For Items Online 50 Off Www Ingeniovirtual Com